Targeted Redistribution, Rather than Torts, Should Address Slavery Reparations, Logue Says

Posted November 19, 2004

Professor Logue’s paper,

“Reparations as Redistribution,”

will be published in the

forthcoming Boston University

Law Review, Vol. 84, Issue 5.

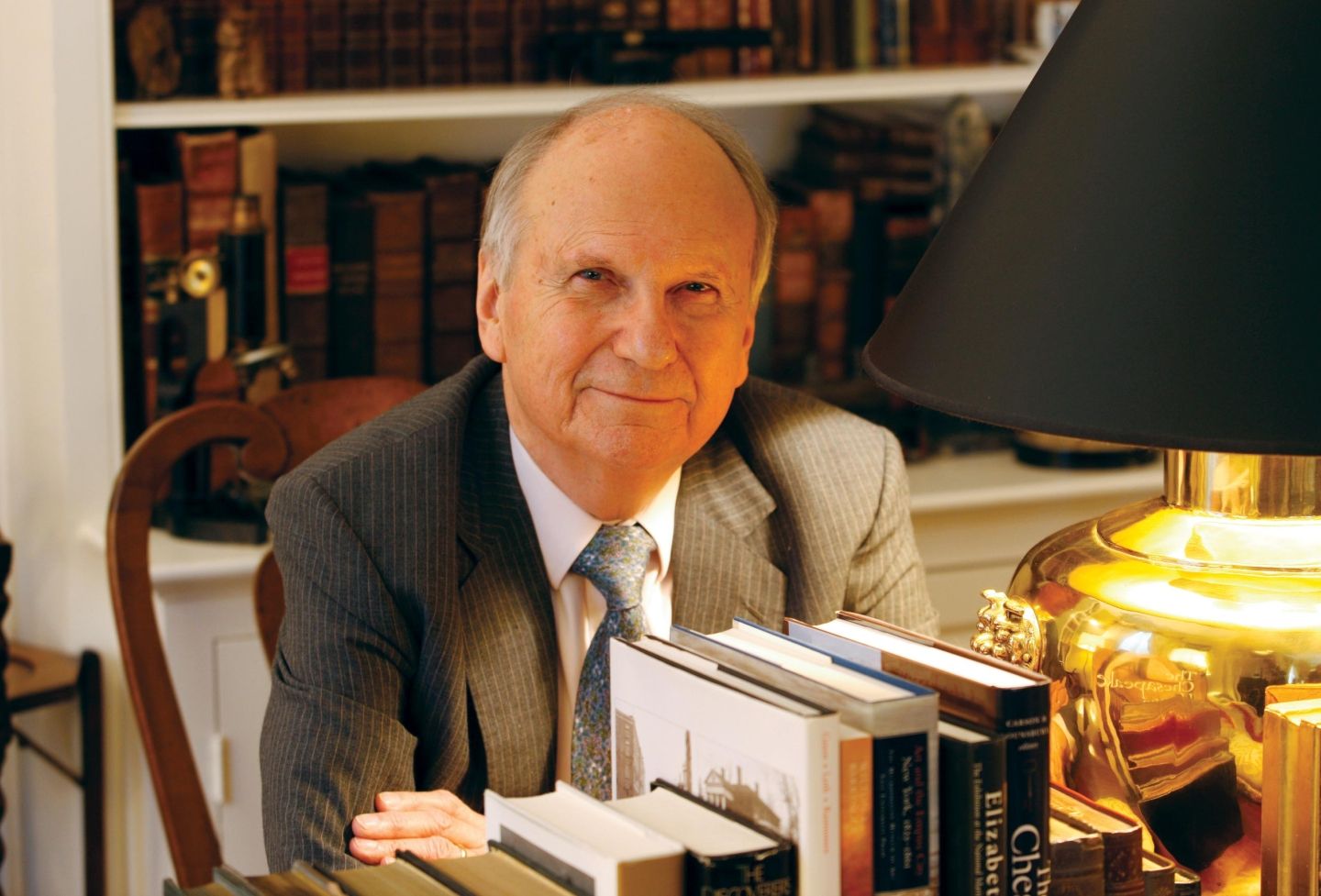

Seeking reparations for slavery through class action lawsuits may not be as effective as programs that incorporate some element of racial redistribution, said Visiting Professor Kyle Logue at a talk sponsored by the Center for the Study of Race and Law Nov. 16.

Logue, a University of Michigan law professor who focuses on tax, torts, and legal transitions, began studying the topic after he was asked to contribute a symposium paper on the use of private law to justify and implement slavery reparations. “I wound up focusing on it in a completely different way,” he said.

Some victims of historical injustice have been successful in seeking reparations. Holocaust survivors settled with financial institutions that profited from their association with Nazis, for example, and Japanese-Americans who were interned during World War II received government compensation. By contrast, recent class action lawsuits brought by descendants of slaves against companies who profited from slavery have been dismissed.

“What seems to me to be the core issue that motivates the [reparations] movement is the persistent and substantial inequality between African-Americans and whites, in particular, but non-African-Americans more generally, along a whole host of dimensions,” he said. “If those disparities in well-being didn’t exist, I’m not so sure there would be pressure for slavery reparations.”

Unlike torts, redistribution has precedents in addressing racial inequalities—many government-approved policies, such as affirmative action, “can easily be characterized as a form of racial redistribution.”

Redistribution also has a political theory rationale the government has followed before: that we should use the power of the state to reduce a substantial amount of inequality that is beyond a person’s control. The progressive income tax, in which those with higher incomes pay a larger percentage of their income, is based on this principle, Logue pointed out. Not all differences in income can be attributable to hard work. “We reduce this inequality through the tax system.”

Logue said there are gaps between African-Americans and whites on many measures of well-being. The median household income for blacks in 2002 was $29,000 and $47,000 for whites. Roughly 24 percent of African-Americans and only 8 percent of whites fell below the poverty line, according to the last census report. The median net worth for black households was $9,771 and $72,000 for whites. African-Americans also fare worse on other factors of well-being, including housing, education, and health. Mortality among African-American babies is more than double that of whites, and blacks face higher incidences of the worst kind of lung and heart disease.

Some argue that these inequalities are a result of individual choice, Logue said. “I think it’s implausible.” He pointed to the fact that significant differences in health remain even if you control for socioeconomic status, suggesting other factors such as discrimination may play a role. Discrimination and even much of one’s culture are beyond the control of an individual, he said.

In any event, Logue insisted, if you’re going to redistribute with respect to race, there are certain policy-design questions that must be considered.

Logue addressed some arguments against redistributing through tax policies, noting that if you distribute with respect to income, “you change the relative price of labor,” creating incentives not to work.

But a lump-sum transfer does not distort labor choices, Logue said, making it the “holy grail” from an efficiency perspective. Racial transfers are especially compelling because race correlates with differences in well-being, but unlike income or wealth, is not a function of labor choices.

Ideally the government could redistribute on the basis of individual factors such as income, health, and housing—but it would be expensive to focus on each issue. Because race statistically correlates so well with these factors of well-being, race provides a proxy that delivers considerable redistributive “bang for the buck.” Logue also said that for such a program to work, questions about whether the transfer would be direct or indirect, cash or in kind, would need to be resolved, and his article on the subject seeks to work out some of these issues.

As a “thought experiment,” Logue suggested the idea of a federal tax credit for African-Americans, which he described as “politically infeasible,” but nevertheless useful in identifying the costs and benefits of alternative programs of redistribution. Such a plan, which would transfer cash from whites to African-Americans, would have the benefit of being comprehensive and could be means tested, he suggested. In operation, the tax credit would work much like the earned-income tax credit, for which citizens file to get a refund whether they owe taxes or not.

The downside? Besides the fact that it is probably unconstitutional, such a program would “[put] a lot of pressure on the definition of race. Who is African-American?”

A similar problem confronts affirmative action in college admissions. Logue called the University of Michigan’s admissions office to see whether the school checks on applicants’ claimed racial identities—they didn’t, and hadn’t heard of any schools who did. “No one [Logue] encountered in higher education] thinks there’s a lot of fraud,” he said, and there’s no evidence to suggest there is. But a tax credit based on self-reporting of race would likely lead to fraud.

One type of racial redistribution that currently exists in our legal system is prohibitions on racial discrimination in insurance pricing. Although blacks have higher health costs and shorter life expectancies, “it is illegal to charge higher premiums to African-Americans,” he said. “This results in a natural redistribution in insurance pools between non-African-Americans and African-Americans.” Such a system could in theory be applied to pensions or social security, where African-Americans often receive reduced benefits because of their shorter life expectancy. However, the insurance model is not as comprehensive or as easy to means test as an African-American tax credit would be. Some of the benefits of insurance pools are mitigated when or if insurance companies use other proxies such as geographic location to circle around the race issue, he said.

Logue said that although he normally is a fan of “internalizing costs through legal rules,” including tort rules, this approach does not make sense in the context of slavery reparations. The more time that passes between the initial injury and the lawsuit, the more difficult it is to justify the award of a tort claim. Intergenerational claims don’t usually make it past one generation (if that), making slavery claims based on ancestry less likely to win as well. Thus the issue of slavery reparations “looks like an issue of redistribution” and should be debated on those terms, Logue said.

Challenged by an audience member about the lack of a link between his proposals and slavery reparations, Logue reaffirmed that he believed the current inequality between blacks and whites resulted from—if not slavery—then Jim Crow laws and subsequent discrimination. He argued, however, that his proposal does not depend on linking redistribution to past actions, but said the case for redistribution should go forward as long as such inequality exists.

An audience member pointed out that failing to link a redistribution program to slavery would make it difficult for whites to agree to the plan.

Logue conceded this point and responded that in-kind subsidies that are not tied to race may be the most politically feasible and most desirable form of racial redistribution. In-kind subsidies might include funding for education and housing for the poor.

Logue acknowledged the difficulty of convincing taxpayers to buy into a redistributive tax credit, and noted there are limits to raising wealthy taxpayers’ rates. “You can destroy your economy—you can just completely destroy your economy— if you raise marginal rates at the high end too much. There’s always a trade-off between efficiency and fairness in tax law.”

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.