Cities need money to operate. When the economy slumps and the tax base weakens, it’s tempting for municipalities to turn to alternative methods of raising revenue, including fines administered by police departments.

In Ferguson, Missouri, that approach proved disastrous. Aggressive policing, including through the administering of fines, culminated with a white police officer fatally shooting a black resident — 18-year-old Michael Brown — and led to riots in 2014.

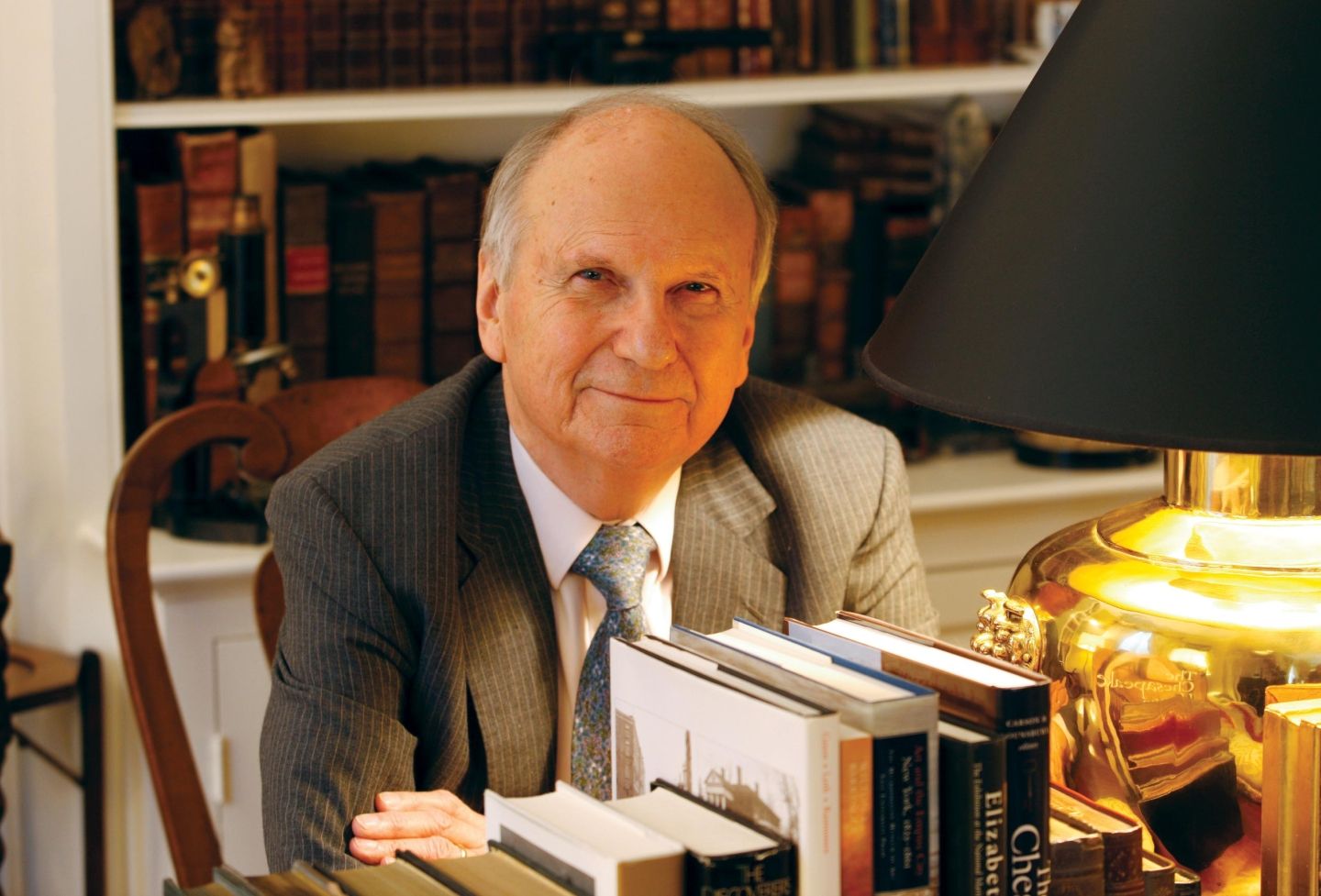

Mildred Robinson, a University of Virginia School of Law professor who is an expert in taxation and on issues of race and law, looks at the problem in her latest paper, “FINES: The Folly of Conflating the Power to Fine with the Power to Tax,” forthcoming in the Villanova Law Review.

Robinson contends that not all fines are bad, but that changing the policing model — from “protect and serve” to “revenue collector” — creates a dynamic that’s rife for the erosion of civil liberties and other problems.

What got you thinking about this topic: the line between fines and taxation?

This piece is the outgrowth of my interest in public finance generally — an area that I think has received far too little attention in general in legal literature. My interest in this topic was a reaction to the Ferguson tragedy and my own desire to understand as much as possible the various factors that may have contributed to the present situation there.

I was surprised upon the release of the Department of Justice report to learn of Ferguson's extensive reliance upon revenues from traffic fines and court imposed fees and penalties to balance its municipal budget. The Justice Department found that law enforcement practices were shaped by the city's focus on revenues from traffic fines rather than on safety needs and that, "the emphasis on revenue compromised the institutional character of Ferguson's police department, contributing to a pattern of unconstitutional policing especially against the city's predominantly black and poor population."

Reliance on traffic-fine revenue collected by the police force for general governance expenses represents a significant departure from local governments’ historic reliance on various levies otherwise imposed.

As this shift occurs, governance costs are increasingly borne by those residents relatively less able to bear them. All of this became even more troubling in Ferguson, where evidence established a racial animus in ticketing practices. The combination of factors led to the Department of Justice’s conclusion linking revenues practices with patterns of unconstitutional policing.

My interest was further piqued by the United States Supreme Court's holding in Utah v. Strieff, decided in 2016. In that case, the court held that a suspect subject to a valid, unrelated outstanding arrest warrant (in this case, for an unpaid parking ticket) could be searched pursuant to that unrelated warrant during an unconstitutional stop — and incriminating evidence incident to that search could be used against him.

The Justice Department’s Ferguson report noted that of 21,000 people living in Ferguson, 16,000 had outstanding arrest warrants. This datum threw into even sharper relief the range of undesirable consequences that could flow from using the police force as a faux tax collection agency.

Should all fines go, or just certain types?

I have not taken the position that "fines should go." I concede the necessity of fines to curb violations of traffic rules that are related to maintaining public safety. Traffic fines are clearly intended to be a means to effectuate that end (though sanctions need not always be monetary — public service requirements might be imposed, for example, when a cited individual is financially unable to bear the cost of a fine).

I am, however, quite sensitive to the possibility of abuse of the power to fine for purposes unrelated to effective policing. I include among "unrelated purposes" using fines — and here I include not only traffic fines imposed for purely revenue purposes but also lifestyle fines — to supplement general municipal revenues. Lifestyle fines seem particularly problematic; enforcement of ordinances against, for example, leaving residential windows uncovered, seem to have a very tangential relationship, at best, to the public welfare.

In any case, Ferguson is in my view an extreme example of all that can go wrong when the police force becomes a tax collection agency.

Do you see the connection between the ability to fine and aggressive policing as a pervasive problem, or limited to Ferguson and other areas?

Again, I don't see the ability to fine as the problem per se. I think that the ability to fine is necessarily a part of effective policing. As has been pointed out by at least one scholar, fines are extensively relied upon —particularly in traffic courts because they are cheaper to administer, can be undone in the event of a wrongful conviction and can be matched to the offender's means. Further, individual officers have traditionally had discretion to warn or ignore rather than cite or arrest. It may even be the case that, in order to accomplish specific objectives, aggressive policing is justified. Setting up additional checkpoints to monitor drinking and driving comes to mind as an example. Additional revenue could well be realized incident to that, a logical consequence to that temporarily intensified activity.

Difficulty ensues, however, when, as was the case in Ferguson, revenue needs became the primary factor for aggressive policing practices. In fact, there exist data that suggest that there are many municipalities in addition to Ferguson where revenue needs animate police practices. That is a problem in my view, even given that the extreme consequences witnessed in Ferguson remain relatively rare.

My continuing concern is that such reliance is not unique to Ferguson. There are likely many other municipalities that are similarly situated and that choose to address budgetary shortfalls by transforming the local police force into agents for revenue collection.

As I also briefly note, the temptation to pervert the power to fine can be effectively foreclosed by barring the use of revenues from fines for general financial purposes. Such revenues might be earmarked instead and used, for example, for education or community enhancement generally.

I think that efforts to reform financial practices in this area might also be attentive to concerns that remain unaddressed, including matching levies imposed to offender's means (or designing alternative sanctions for offending behavior) and setting penalty standards inter-jurisdictionally.

How should municipal governments handle the problem of asking for higher taxes to offset revenue from fines?

This is a very hard question. Two points immediately come to mind and are salient here: 1) Missouri, like many other states, has in place tax and expenditure limitations that permit tax increases only with public approval through appropriate referenda. The governing body in Ferguson did not attempt to seek taxpayer approval for increases in property tax levies prior to turning to its police force. 2) Even had such approval been sought and given, "success" could well have proven to be a pyrrhic victory. Ferguson's budgetary shortfalls became manifest in the first instance because of the collapse in residential values and increasing unemployment incident to the Great Recession of 2008. Taxpayers may well have been unable to meet additional tax obligations.

In short, there are unlikely to be any easy options. Municipalities can (and in the present environment often must) seek taxpayer approval and taxpayers can say "yea" or "nay." Should taxpayers approve such requests, problem solved. Should the additional tax burden be refused, municipalities must either reallocate whatever monies there are available or cut services, or both. I note here that a further undesirable consequence of negative voter outcomes may be reduced services for those most in need of such.

Do you see your paper as just part of a bigger whole in terms of what went wrong there?

I have no doubt that this is the case. I have explored only a tiny part of the tangled web of municipal finance in this piece. The use of traffic-fine revenues in Ferguson was, in my view, a wholly inappropriate official effort to staunch financial bleeding attributable to the failing Ferguson economy. Simply put, the city's tax base was increasingly inadequate; the local economy was not sufficiently robust to sustain the city's level of public expenditure. The unfortunate fact is, however, that ending the unconstitutional policing practices in Ferguson (that included aggressive citing activity) left systemic financial inadequacy unaddressed. As long as the local economy languishes, the likelihood of meaningful economic progress remains slim and the ability to rely on the traditional sources of municipal finance noted above remains stunted. The city will be hard-pressed financially and, with extensive reliance on traffic fines as a revenue source foreclosed, it will continue to face the specter of budgetary and public service reductions if it is to continue corporate existence.

I have made no attempt in this paper to address what I nevertheless see as these very fundamental questions.

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.