When does a seasoned tax expert decide to retire? At age 70½, of course.

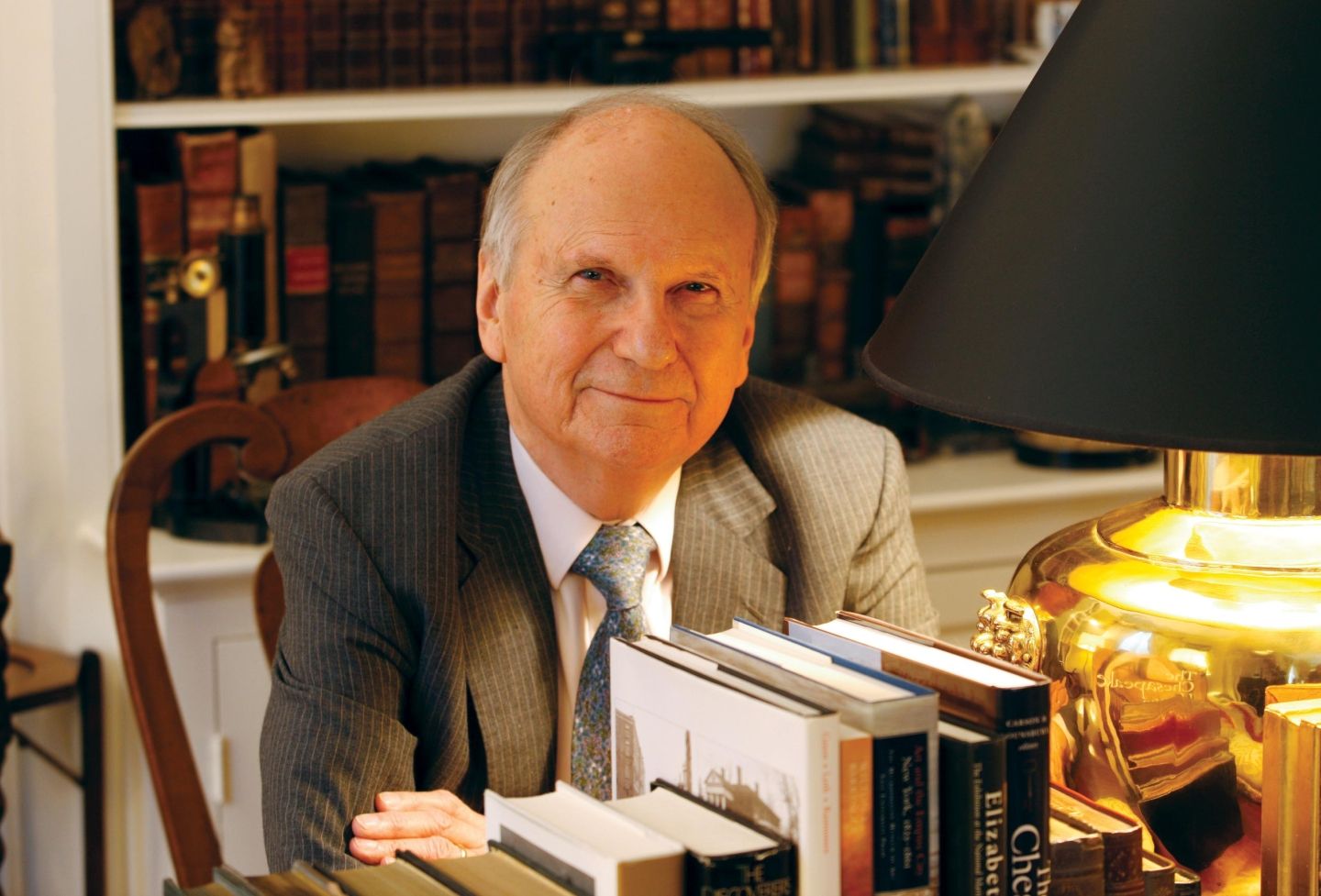

That’s when beneficiaries of retirement plans usually have to start taking distributions — and the age University of Virginia School of Law professor George Yin will be this year. Yin will retire at the end of the spring semester after 25 years on the faculty.

“The Law School has been really wonderful to me,” Yin said. “It just seemed to me that I should think of it as I’ve had my shot and it’s time to pass it on to somebody else.”

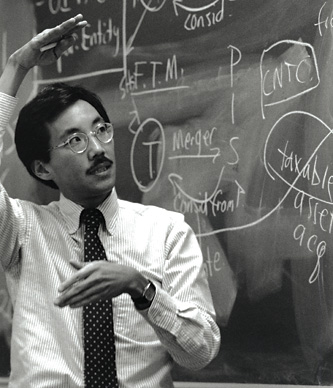

Yin, who began teaching at UVA Law in 1994 after visiting from the University of Florida College of Law, is a noted public servant. From 2003-05, he took leave to serve as chief of staff of the U.S. Congress’ Joint Committee on Taxation, one of the most influential tax positions in the country.

“I had supervisory responsibility for 60 to 70 people, and direct responsibility to every member of Congress, especially the chairs and members of the House and Senate tax committees,” Yin said.

He and his staff assisted Congress on a number of tax bills, including the Jobs and Growth Tax Relief Reconciliation Act of 2003, the Working Families Tax Relief Act of 2004, and the American Jobs Creation Act of 2004.

Under his watch, the committee expanded its ability to perform macroeconomic analyses of tax legislation and completed a major report setting forth options to improve tax compliance and reform tax expenditures.

Yin said he took pride in leading a nonpartisan staff in a highly partisan environment.

“You’re on your own little island, surrounded by sharks of all colors and sizes,” he said. “You’re essentially under challenge and attack by virtually everybody. If you’re doing your job right, nobody really likes you. Our staff was required to perform certain tasks that were essential to the legislative process and potentially affected who would win or lose. Thus, there were inevitable conflicts when the staff’s conclusions were not what one or more members of Congress wanted.”

One burned-into-memory moment from his service was a showdown with a very high-ranking member of the House, who was furious with a critical conclusion of the joint committee staff. The congressman burst into Yin’s office and demanded to see the staffer who had worked directly on the project, with the intention of possibly firing him.

Yin offered to surrender his own job but refused to let the congressman see his staff member, who had done his work correctly. “The conclusion was an institutional one, and I was the head of the office,” Yin said.

Yin’s first major public service was as tax counsel for the U.S. Senate Finance Committee. His work there, from 1983 to 1985, included spearheading a major project to reform and simplify the tax laws dealing with corporate-shareholder transactions, including mergers and acquisitions.

“Up until that point, my focus had been on being a really good private practitioner who advised clients on how the law dealt with their transactions,” he said. But in government, “You’re suddenly in a position to think of the law as malleable rather than fixed.”

He added, “That line of thinking led me into academia — something never before on my radar screen — because that’s what academics have the privilege of doing.”

Yin is retiring at the top of his game as an influential voice in tax policy. He’s become the leading expert on the legal issues involved in the release of the president’s tax returns, and congressional power to acquire and release returns in general.

Professor Jon Cannon, a longtime colleague who has also served in government (including as general counsel to the Environmental Protection Agency), said Yin’s approach to academia has been a template he has emulated.

“George has been a wonderful mentor, colleague and friend ever since I came to the Law School some 20 years ago,” Cannon said. “He combines a practical sense of what’s important with a scholar’s commitment to finding — and saying — the truth. He is unfailingly generous and kind. There could not have been a better model.”

Yin became interested in tax law after taking an introductory tax class in the first semester of his second year at George Washington University Law School.

“My professor was very tough and mean,” he said. “Grades were posted back then, and the grades he handed out were by far the lowest in the school, with about a third of each class flunking. In addition, he was very uncivil in class and would belittle and embarrass the students.

“I was scared to death and therefore studied extremely hard. And lo and behold, maybe as a result, I gradually began to see the patterns and logic that make the tax law so fascinating, something that has captured my imagination ever since.”

Not surprisingly, Yin got the highest grade in the class — in fact, the highest awarded in many years. He nervously approached the professor once grades were posted. Maybe the instructor would soften if they chatted? Perhaps even offer some words of career advice or agree to be a reference?

“He looked at me and said, ‘So, you’re the one? Huh!’ And that was it. That was the extent of the conversation we had.”

After law school, Yin served as a clerk at the U.S. Court of Claims before practicing tax law at Sutherland Asbill & Brennan in Washington, D.C., “a great firm that really advanced my ability as a lawyer.”

When he began teaching law, Yin pondered briefly if he should take the hard-as-nails approach with his own students. Instead, he opted to be his nice-guy self.

“I decided I should teach the way I am,” he said. It’s been an approach that has served him well.

Judge Cary Douglas Pugh ’94, who sits on the U.S. Tax Court, was a student in Yin’s Corporate Tax class when he taught it for the first time at UVA as a visitor. She said his class was recommended to her by others who had known of Yin’s respected service in government.

She was not disappointed.

“George made an otherwise daunting subject accessible,” Pugh said. “People often have a brain freeze when it comes to tax. He made it less intimidating, and much more interesting. He had a respect for the right policy answer, and he has always been very supportive of me, especially after I left the Law School. He affirmed my career in tax and in public service.”

In addition to being a dedicated instructor, Yin has helped with Law School governance, having led the preparation of a report for the most recent American Bar Association seven-year re-accreditation visit and served on the faculty Appointments Committee several times.

He has also published extensively on a broad range of tax topics and consulted with government and policy organizations. Between 1994-99, he was reporter to the American Law Institute’s federal tax project on the income taxation of private business enterprises. He has been a consultant to other ALI tax projects, the Department of Treasury, the U.S. Joint Committee on Taxation, the National Commission on Restructuring the Internal Revenue Service, and the U.S. House Committee on Ways and Means.

He is currently a member of the IRS Advisory Council and serves locally on the board of the Charlottesville Symphony Society.

Prior to going to law school, Yin was a member of Teacher Corps, an earlier version of Teach For America, in which non-education majors teach in inner-city schools. He subsequently served as director of a 100-child day care center in a low-income housing project.

“Working with the problems of my staff and the families of some of my children helped persuade me to think about learning the law,” he said. “I subsequently worked as a computer programmer to begin accumulating funds for law school.”

He also held a number of jobs while attending high school and college. “It will be a little strange not to receive a paycheck for the first time in 56 years,” he said.

He has a master’s in early childhood education from the University of Florida and a bachelor’s degree in mathematics from the University of Michigan. He is a native of New York City.

Yin plans to continue his research as a professor emeritus. “My research still excites me, but I have a number of other interests as well,” he said. “It’s nice to know that if I find something even more engaging, I can change.”

He also intends to spend more time with family — in particular his wife, Mary Walter, and his children and grandchildren — and looks forward to traveling.

“In the short term, I’m going to do something I’ve always wanted to do, which is visit China in the fall when its weather tends to be best,” he said.

Related Articles

- 4.11.18 Professor George Yin Finds Unexpected Family Ties to World Figure, UVA’s Past

- 2.27.17 Professor Energizes Movement to Obtain Trump’s Tax Returns

- 9.30.15 Professor Examines Alleged Taxpayer Privacy Violation by Congress

- 10.16.12 Yin on the ‘Greatest Tax Suit in the History of the World’ and Why It Matters Today

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.