A “wealth tax” on high net worth individuals is officially on the platforms of two Democratic presidential candidates — Sen. Bernie Sanders, who added his this fall, and Sen. Elizabeth Warren, who proposed hers earlier in the year.

Such a tax has been attempted in other nations, but would it work in the United States?

University of Virginia School of Law professor Ruth Mason, a domestic and international tax law expert, says even if wealth tax legislation passed, and cleared legal challenges, implementing one would be difficult.

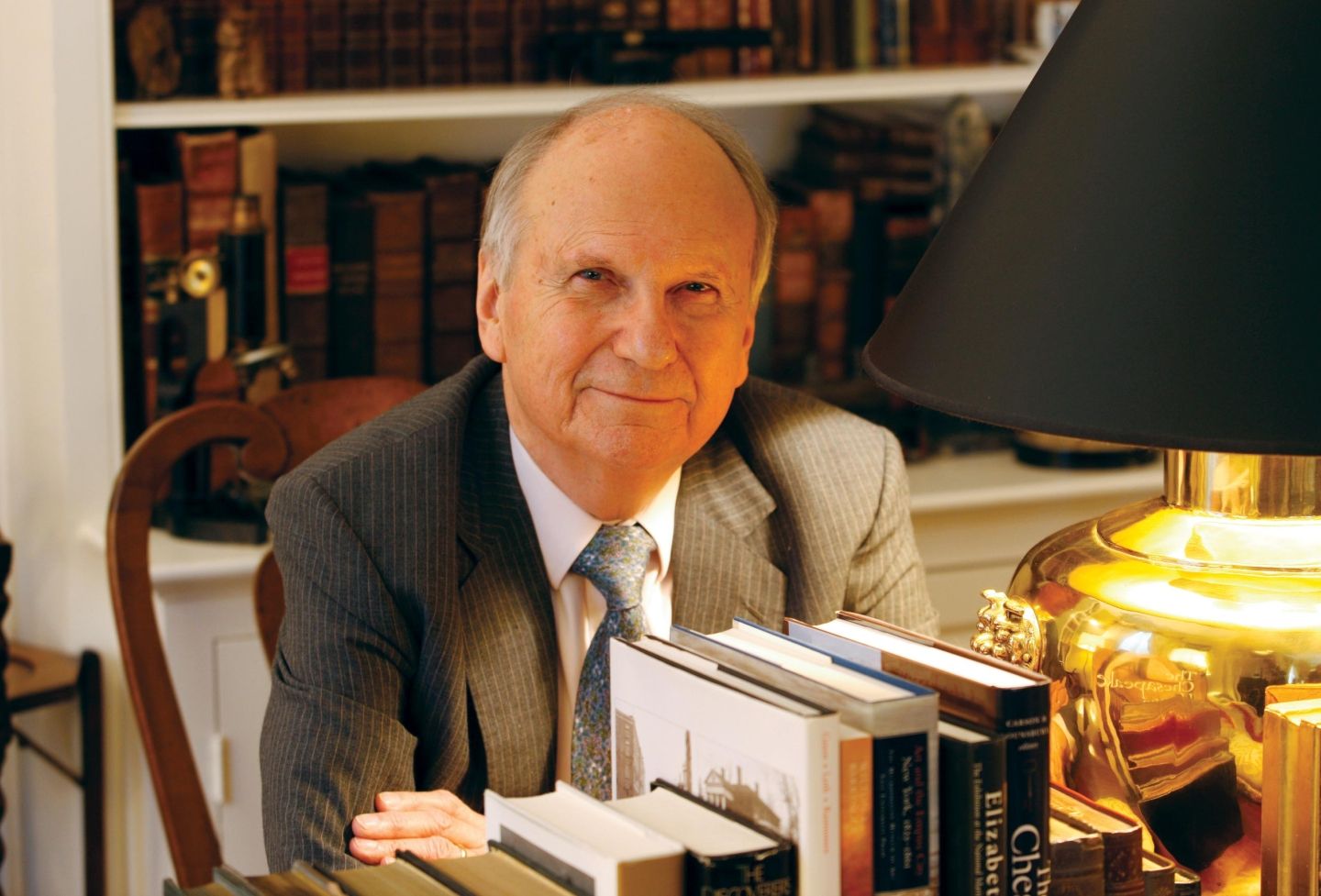

Mason, whose work has been cited by the U.S. Supreme Court, focuses on tax discrimination in the United States and the European Union. She co-edits Kluwer’s Series on International Taxation and is a member of the editorial board of the World Tax Journal. At UVA, she is the Edwin S. Cohen Distinguished Professor of Law and Taxation, and Class of 1957 Research Professor of Law.

She recently discussed how a wealth tax might play out and what obstacles the proposal would face to become law.

What is a wealth tax?

A wealth tax is a periodic tax on the value of your assets, as opposed to your income from those assets. The recent proposals by Sens. Elizabeth Warren and Bernie Sanders would have very large exemptions, and so would only subject very wealthy people to the tax.

What are the chances of the tax passing?

I think that the political chances of the United States enacting a wealth tax are slim. Even if such a tax were to pass politically, there would still be legal obstacles. Although not enough people are paying attention to this issue, wealth taxes may be considered so-called “direct taxes” for constitutional law purposes.

What is a direct tax, and what is the related constitutional issue?

Economists use the terms “direct tax” and “indirect tax” to convey whether the legal liability for a tax matches who bears its economic burden. So, for example, an economist would call a retail sales tax an indirect tax because, although the law places the obligation on retailers to remit the tax, the cost of the tax is passed through to the customer in the form of higher prices. Thus, the consumer bears its economic incidence. In contrast, a direct tax is one in which the legal liability matches the incidence. An example is the individual income tax.

The Constitution also uses the term “direct tax” and requires direct taxes to be apportioned to the states according to their population. For example, if the population of California is 10 times that of Connecticut, then the tax collected from residents of California must be 10 times the tax collected from residents of California. If average per capital wealth differs by state — and it does — then a wealth tax that applies uniformly across the states will not be apportioned by population.

The question is whether wealth taxes are direct taxes subject to the apportionment requirement. There isn’t much insight from constitutional debates about what the framers meant by “direct taxes,” and the Supreme Court has only been called upon to interpret the term a few times. The 16th Amendment, ratified in 1913, empowered Congress to assess income taxes without apportionment.

At a minimum, a wealth tax that included real property would be in part a direct tax subject to apportionment. It would be difficult, although perhaps not impossible, to apportion such taxes.

What would enforcement look like?

Enforcing wealth taxes is notoriously difficult because it requires detection and valuation of people’s assets, many of which may be held offshore. Some of the hardest assets to value are things like closely held stock or artwork. But, despite the difficulties, it is important to include such assets in the tax base, because they represent an important store of wealth.

New laws allow governments to peer into secret Swiss bank accounts, but Switzerland and other countries have diversified; they now offer luxury freeports: state-of-the art climate-controlled secure warehouses for stashing the art and wine collections of the superrich away from the prying eyes of government. A committee of the EU Parliament recently studied the role of such freeports in tax evasion, including their role in hiding art. Under a wealth tax, the superrich could move wealth from highly regulated assets--such as reportable bank and investment accounts--to art and other less detectable assets.

How have wealth taxes fared in other countries?

Not very well. Lots of European countries used to have wealth taxes, but they gave them up due not only to their unpopularity but also to the administrative difficulties inherent in them. Proponents of wealth taxation in the United States hope that by applying wealth taxes only to the superrich, they can neutralize political opposition to such taxes. But narrowing the application of the tax to the superrich does nothing to address the detection, valuation and avoidance problems with wealth taxes. In fact, it could worsen them by focusing the tax on the segment of the population that can call on the most resources to dodge it.

How much revenue would a wealth tax generate?

Although economists have made estimates, we can’t answer that question yet because it will depend on the exact features of the tax as well as the behavioral response to the tax.

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.