The United States maintains a massive debt load — currently about $23 trillion — and nobody knows if or when it might lead to an existential crisis for the country.

Two University of Virginia School of Law professors assert in a new paper that restructuring that debt, like a business in trouble would, should be on the table in case of emergency.

While the nation can’t simply file for Chapter 11 bankruptcy reorganization, business law experts Julia Mahoney and Edmund W. Kitch contend that a similar idea for the cash-strapped federal government isn’t crazy — and may actually be workable.

The idea originated from a class they taught together on constitutional aspects of fiscal and monetary policy, including actions taken to address the financial crisis of 2008. The professors arrived at the conclusion that debt restructuring may eventually be a necessity because of popular but deficit-ballooning programs, such as those involving the social safety net and national security, combined with some future unforeseen downturn.

“We doubt that payments on treasury obligations will necessarily take precedence over what the electorate sees as more pressing needs,” Kitch and Mahoney write in “Restructuring United States Government Debt: Private Rights, Public Values, and the Constitution,” forthcoming in the Michigan State Law Review.

If the government prints more and more money to try to keep its promises while also facing insurmountable debt, the result could be runaway inflation, the professors say. They reference what happened in Argentina, which experienced a 53.8% annual inflation rate in 2019 while simultaneously attempting to renegotiate its indebtedness.

But is U.S. debt restructuring constitutional? Despite some conventional thinking to the contrary, Kitch and Mahoney say that because the Constitution doesn’t expressly prohibit it, such a move is indeed possible.

“Nothing in the Constitution as originally ratified forbids debt restructuring,” they write.

Some interpret the 14th Amendment’s Public Debt Clause as a blanket prohibition on the federal government’s failing to make its debt payments. But while the clause affirms the validity of U.S. debt, “failing to pay a debt in full and on time is not at all the same thing as questioning the debt’s validity,” they write.

The professors acknowledge that the U.S. has a strong legal history of upholding property and contract rights, which could serve as barriers to any restructuring deal.

But they also point to precedent. Even though the public has largely forgotten, the U.S. has restructured its debt twice: under Alexander Hamilton’s debt repayment scheme in the 1790s, and later, at the start of the New Deal, when the U.S. abandoned the gold standard.

The professors suggest that a liquidity fund that the secretary of the treasury could access would be the most feasible way to enable the government to perform its most important functions while it pursued a restructuring of its obligations. “The long existence of the Exchange Stabilization Fund shows that the idea that the Secretary of the Treasury needs access to discretionary funds to deal with unexpected events is well-accepted,” they write.

Nevertheless, they aren’t betting against the U.S. economy, they say. They just think it might be wise to be prepared.

Advanced planning of this kind, however, is anathema to government leaders and their messaging, they point out.

“To date, there is no sign that federal government officials have any appetite for thinking seriously about restructuring as an option,” they write. “Their failure to do so is readily explainable: to contemplate default would be to admit tacitly that United States debt securities are not in fact risk-free.”

Last year, the UVA Office of the Executive Vice President and Provost honored Mahoney with a Provost Award for Collaborative Excellence in Public Service for her efforts to communicate the lessons of the recent financial crisis. In addition to the class she taught with Kitch, Mahoney led a conference on the subject at the Brookings Institution in Washington, D.C., which she helped organize with David Leblang, a UVA professor of politics.

Mahoney is the John S. Battle Professor of Law, and the Class of 1963 Research Professor in Honor of Graham C. Lilly and Peter W. Low. She teaches courses in property, government finance, constitutional law and nonprofit organizations.

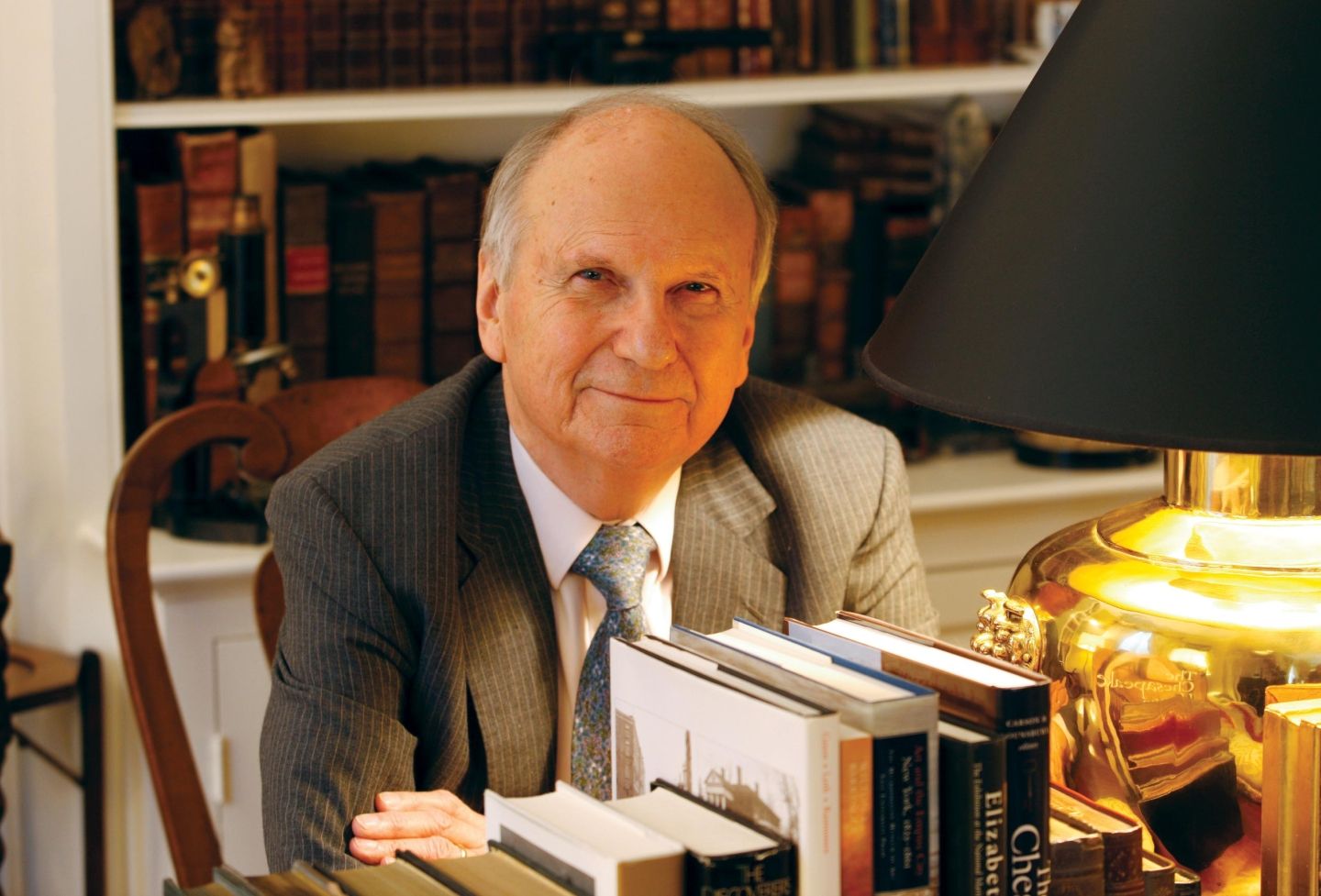

Kitch is the Mary and Daniel Loughran Professor of Law. His scholarly and teaching interests include agency, corporations, securities, antitrust, industrial and intellectual property, economic regulation, and legal and economic history.

Julia Mahoney

- “Foreword: Altruism, Community, and Markets” (with Kimberly D. Krawiec and Sally S. Satel), 81 Law & Contemp. Probs. 1 (2018).

- “America's Exceptional Safety Net,” 40 Harv. J.L. & Pub. Pol’y 33 (2017).

- “Takings Claims in the Aftermath of Financial Crisis,” Harvard Law School Forum on Corporate Governance and Financial Regulation, April 8, 2016.

- “Takings, Legitimacy, and Emergency Action: Lessons from the Financial Crisis of 2008,” 23 Geo. Mason L. Rev. 299 (2016).

Edmund Kitch

- “Proposals for Reform of Securities Regulation,” 41 Va. J. Int’l L. 629 (2001).

- “Elementary and Persistent Errors in the Economic Analysis of Intellectual Property,” 53 Vand. L. Rev. 1727 (2000).

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.