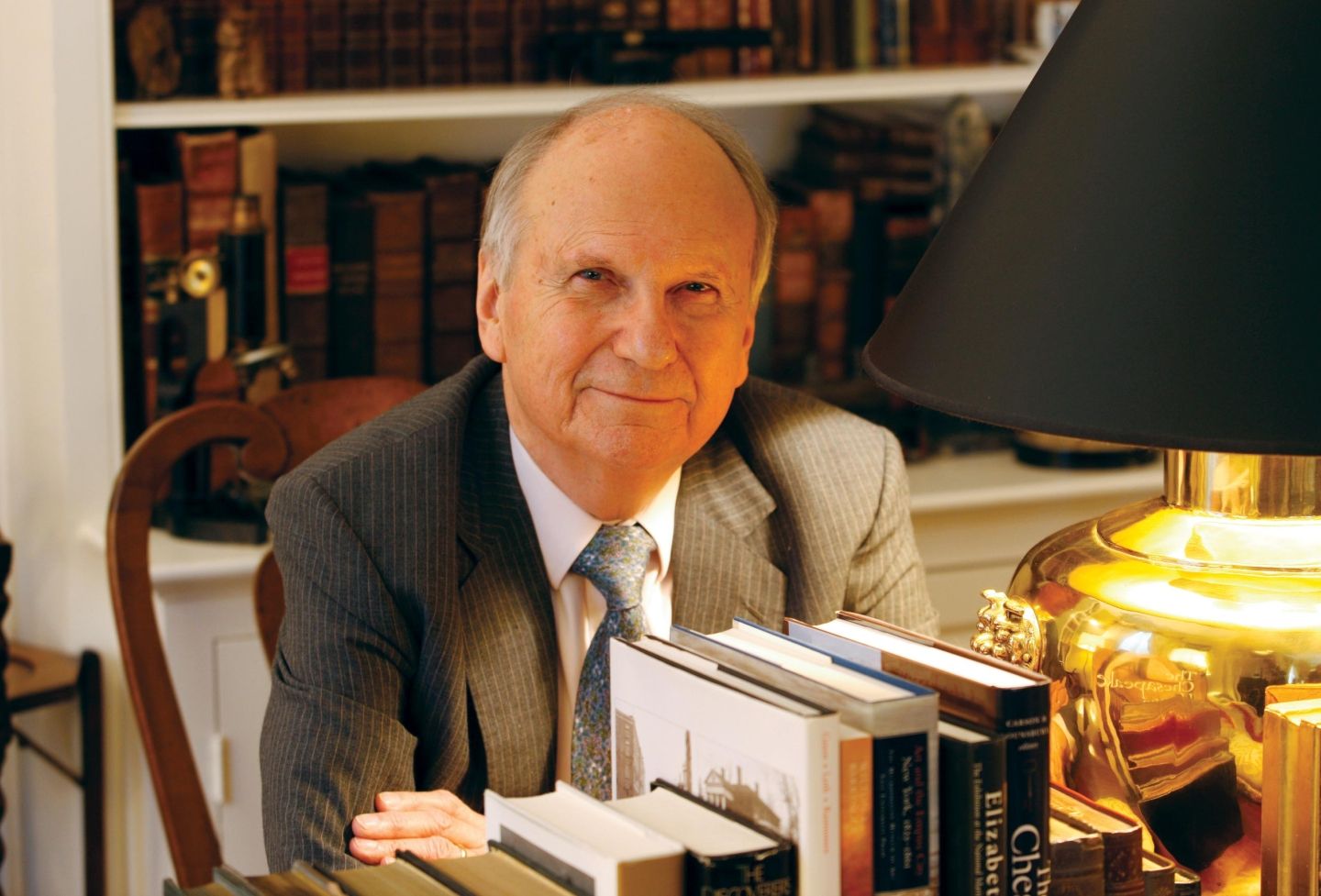

Managers of index funds are increasingly taking on the role of investment advisers, and federal regulators should treat them as such, University of Virginia School of Law professor Paul G. Mahoney argues in a new paper.

Mahoney, whose teaching and research focuses on securities regulation and corporate finance, recently co-authored “Advisers by Another Name” with University of Toronto law professor Adriana Robertson. In the paper, they explain why the U.S. Securities and Exchange Commission’s policies are outdated in how they regulate some index funds, which consist of a portfolio of companies meant to track a market index, such as Standard & Poor’s 500 Index, rather than being actively managed. The professors offer a solution to close regulatory gaps on index funds that are blurring the boundaries, without burdening the market.

Their paper has already garnered attention from the Financial Times, and the scholars posted about their work on the Harvard Law School Forum on Corporate Governance.

Mahoney discussed why and how the current system should be updated to better regulate indices and benefit investors.

What inspired you and your co-author to write this paper?

We observed that the index fund market is changing. Many index funds and exchange-traded funds today are thematic. In other words, they do not try to replicate a broad market portfolio, but instead consist of stocks with some characteristic that the fund selects. Sector-specific index funds and “smart beta” ETFs are an example. These funds blur the line between indexing and active management.

Why have index funds grown in popularity?

There is a substantial body of academic research that suggests that on average, actively managed funds do not outperform the relevant market benchmark (like the S&P 500) net of expenses. That has led many investors to decide to try to match the market return using an index fund rather than try to beat it using an actively managed fund. Index funds are generally less expensive because the fund’s manager does not engage in costly attempts to find undervalued stocks — it just tries to replicate the relevant index.

The problem we are responding to is that the line is becoming blurred. For example, an index fund or ETF that focuses on high-growth biotech companies is obviously not trying to replicate the entire stock market or a substantial segment of it. Implicitly, the fund sponsor is trying to attract investors on the basis that holding this specialized slice of the market will produce superior returns or meet other investment goals.

That is not to say that there is anything wrong with these thematic funds, and our paper does not argue that there is. It simply makes the point that they resemble active funds that have an adviser/sub-adviser structure, and the index provider should be regulated as a sub-adviser.

How is the current system antiquated?

The current regulatory system is premised on the idea that there is a sharp line between index funds and actively managed funds. The latter select stocks that the manager thinks will outperform the market, and the former passively track the market. That was never completely true in the sense that even a broad market index must make choices about which portfolio best reflects “the market.” But it was close enough to justify the different regulatory treatment for a time. It no longer is.

How are index providers investment advisers?

We must divide indices into two categories. The first, which we call “general” indices, purport to represent a large segment of the market and accordingly have many different uses. The S&P 500, for example, is supposed to represent the universe of large-cap stocks. Active managers use it as a benchmark; the evening news uses it as a shorthand for how “the market” performed today. Hundreds of funds track it. There is a reasonable argument that the companies that provide these indices are data publishers rather than investment advisers, assuming they have procedures in place to ensure that the index committees that select stocks for the index are unconflicted.

We call the second category “single purpose” indices. They exist for the sole purpose of being tracked by a fund. The fund’s sponsor asks an index provider to create an index having the desired characteristics. These thematic funds, by their nature, seek to hold a small subset of stocks that the manager argues will outperform the broader market, either alone or in connection with other strategies.

The provider of a single purpose index, we argue, meets the regulatory definition of an investment adviser. It is in the business of selecting investments for a fund. Unlike the provider of a general index, it does not fit well within the statutory exclusions for publishers.

What should the SEC do to better regulate the index fund market?

First, it should recognize that the providers of single purpose indices are functionally the same as sub-advisers, or specialized asset managers to whom some fund managers contract out all or part of the stock selection. The SEC should regulate them as sub-advisers.

Second, the SEC should clarify the distinction between data publishers and advisers. This would not be very disruptive. The SEC should tell index providers that they must have procedures in place to manage potential conflicts of interest between index selection and other commercial or financial interests of the index provider or its affiliates. Large index providers say they do this. It should also require that an index fund’s prospectus disclose the licensing fee for the index as a separate line item rather than bundling it with administrative expenses. Most index providers do not do this and would no doubt object, but there is no good argument why those fees should not be transparent to investors.

How would these new regulations benefit investors?

They would do the two main things that securities law is supposed to do — inform investors about the costs they pay and about the potential conflicts of interest to which they are subject.

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.