More than 130 countries agreed earlier this month to make it harder for the biggest tech companies, such as Google and Facebook, to profit from digitization without paying what those governments view as a fair share of taxes.

Professor Ruth Mason of the University of Virginia School of Law, an international tax expert, said the multinational agreement has long-term implications for global tax policy.

The move is estimated to raise over $100 billion worldwide annually, Mason said, but how much the plan will actually raise will depend, in part, on how companies react.

“The tech companies didn’t block the process, but once countries implement the agreement, their lawyers will begin to figure out how to minimize new taxes,” she said. “That’s inevitable. I think of all of these revenue estimates as being highly contingent on behavioral response, which we don’t know yet, because we don’t know what the rules will be in detail.”

The nations agreed Oct. 8 to back the two-pronged proposal, which was brokered by the Organization for Economic Co-operation and Development. The reforms are slated to apply to fewer than 100 companies — those that make upward of $870 million a year.

Under current tax treaties, corporations only pay taxes on their business profits where they have a physical presence, such as stores. The first part of the pact aims to change that rule. To protect countries from companies that reap outsized profits through social media and other digital services that do not require a physical presence, the countries agreed to a new tax nexus that doesn’t require physical presence.

Now, “they’ve identified a pot of money, a portion of the profits of the world’s most profitable companies, that will be taxed in jurisdictions where those companies have sales,” Mason said.

The plan would replace a plethora of digital service taxes, a stopgap solution to the problem of taxing multinational firms that lack a physical presence. The digital service taxes resulted in a mishmash of approaches among nations, and companies complained that they taxed the same income more than once.

The second part of the agreement outlines an optional 15% minimum tax rate on the world’s most profitable companies.

“It’s about preventing profit-shifting, which is when companies put their income into low-tax jurisdictions,” Mason said. “And to some extent it’s about curbing tax competition.

“The U.S. was definitely pushing the minimum tax because the Biden administration wants to increase domestic corporate tax rates to fund the infrastructure bill. So this international stuff is in part driven by domestic politics and domestic revenue needs.”

While the fine points are still being agreed upon, the deal is a watershed in international tax cooperation, Mason said.

“The big story here is that 136 countries agreed on anything. And even though the number of companies affected is small, this deal may be just the starting point.”

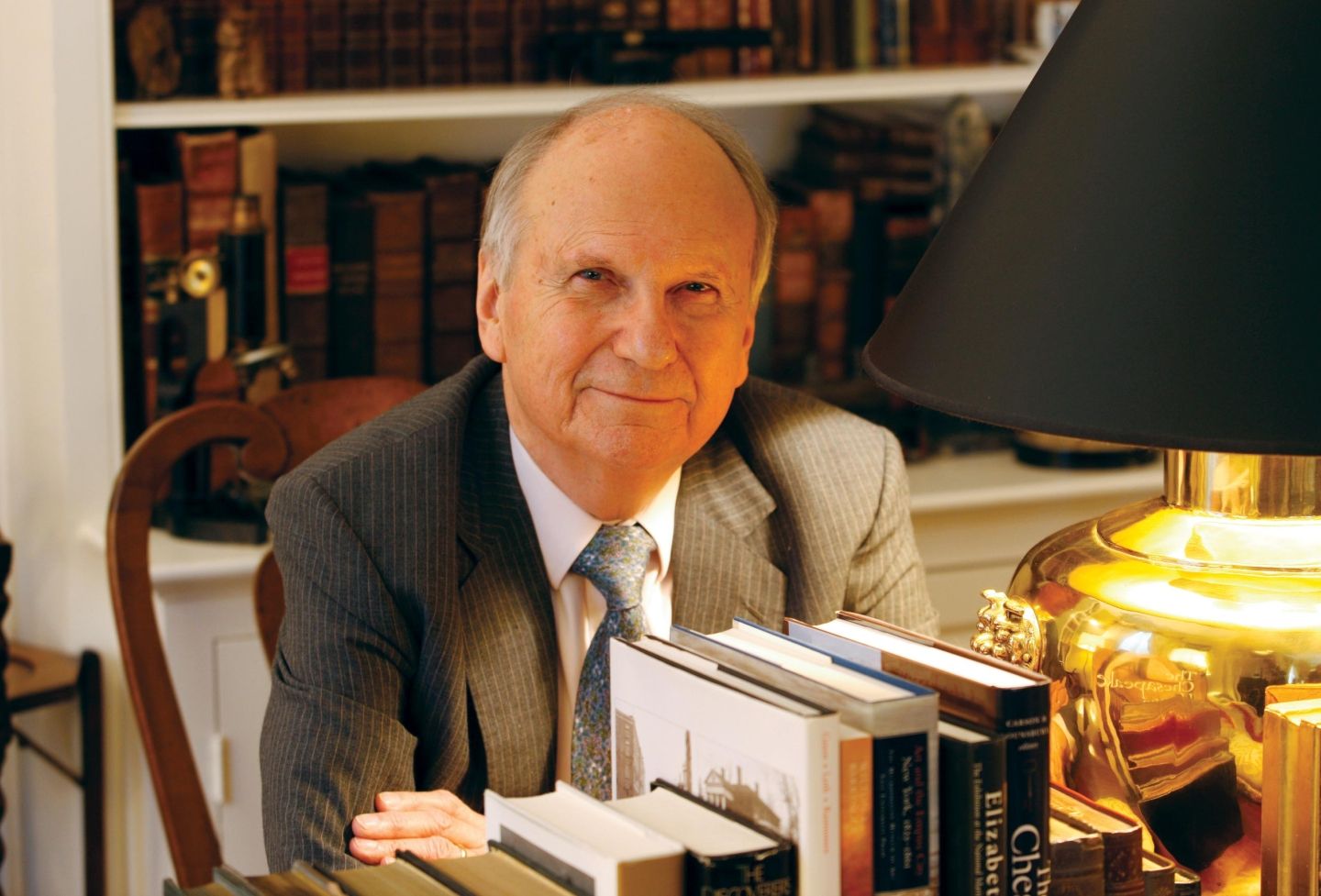

Mason is the Edwin S. Cohen Distinguished Professor of Law and Taxation, and the Class of 1941 Research Professor of Law. She co-edits Kluwer’s Series on International Taxation, and she is a member of the editorial board of the World Tax Journal. Her recent work considering multilateral efforts to reform corporate taxation include “The 2021 Compromise,” “The Transformation of International Tax” and “Digital Battlefront in the Tax Wars.”

She discussed the reform issue in a 2019 episode of the “Common Law” podcast and in her chair lecture.

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.