A new book by Professor Pierre-Hugues Verdier of the University of Virginia School of Law may help dispel a widely held belief: that big banks don’t pay when they run afoul of the law.

In “Global Banks on Trial: U.S. Prosecutions and the Remaking of International Finance,” Verdier reviews the repercussions — which he says have been both substantial and largely beneficial to society — stemming from U.S. prosecutions and other enforcement actions aimed at foreign banks. The book is published by Oxford University Press.

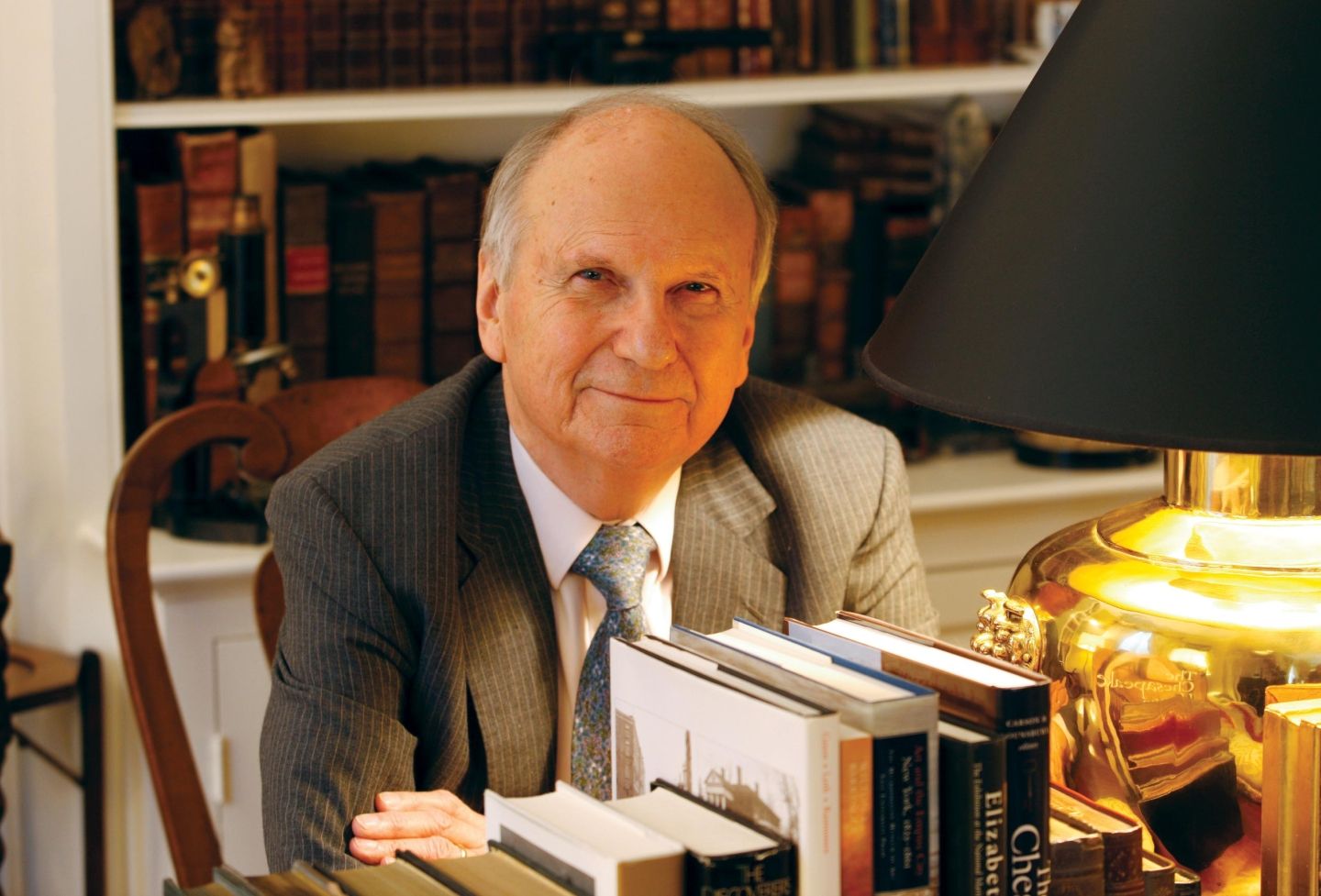

“The assumption by a lot of people, especially before the financial crisis, was the largest banks in the world were outside the purview of the U.S. criminal justice system,” said Verdier, an expert in international law and banking regulations. He serves as the John A. Ewald Jr. Research Professor of Law.

Essentially, he said, the United States and other nations felt that as long at the banks weren’t acting as criminal organizations, they should largely be left alone.

“I think after the financial crisis that perspective changed,” he said. “Real questions were raised about the effectiveness of existing bank examinations and about the oversight and priorities of regulatory agencies. And I think that might have encouraged prosecutors to take a closer look.”

The book explores instances of benchmark manipulation, tax evasion and sanctions violations.

In the first case Verdier examines, federal prosecutors working with the U.S. Commodity Futures Trading Commission revealed that global banks Barclays and UBS were manipulating LIBOR, a benchmark used to set interest rates in financial contracts worldwide.

In July 2012, Barclays paid $360 million to the Department of Justice and the trading commission, triggering a major scandal that led the bank’s CEO to resign. Then, in December of that year, the commission ordered UBS to pay $700 million in fines. The bank shelled out more than $500 million to settle the Justice Department case. U.S. and U.K. prosecutors also prosecuted at least 35 traders and brokers for manipulating LIBOR.

But the fines and prosecutions from that case were just the start, the professor said.

The investigation disclosed evidence that other world benchmarks, related to transactions in the trillions of dollars, were also being manipulated. That resulted in more prosecutions and settlements, including proactive reporting by other banks that sought leniency from prosecutors, and substantial corporate and regulatory reforms worldwide. The banks have since spent billions on human and technical monitoring to ensure compliance. LIBOR is now being phased out worldwide to be replaced by more reliable benchmarks.

Verdier said without the Department of Justice, working in concert with the trading commission and the FBI, such a systemic change may have never happened.

In another chapter, he looks at the prosecution of UBS to force disclosure of information on offshore accounts held by U.S. taxpayers. The action preceded the Foreign Account Tax Compliance Act and a new system of nation-to-nation tracking and reporting, which reduce tax evasion worldwide.

Global banks such as UBS, Barclays, HSBC and BNP Paribas have collectively paid tens of billions of dollars in fines since the 2008 crisis thanks to the efforts of U.S. prosecutors in dozens of cases — although prosecutions have slowed somewhat in recent years, Verdier said.

He noted that aggressive action by U.S. prosecutors or other federal leverage on foreign banking may have its drawbacks in the future. The U.S. has control over vital hubs in the international banking system, but foreign nations and banks may choose to rely less on the U.S. dollar and U.S. payment systems, removing a potential source of leverage.

“Global Banks on Trial” is Verdier’s first book for which he is the sole author. He is also co-editor, with Mila Versteeg and Paul Stephan ’77, of the 2018 book “Comparative International Law.”

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.