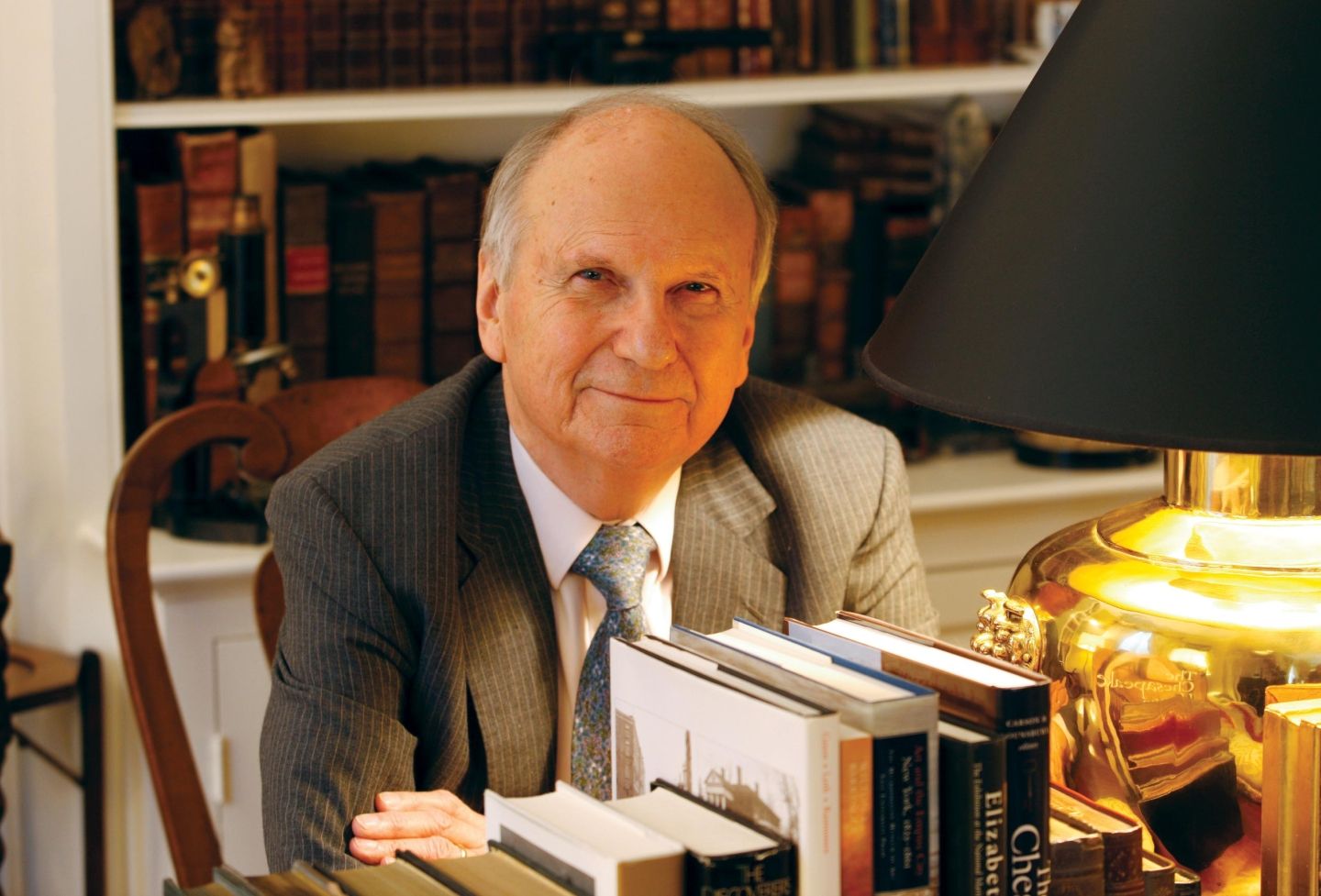

Russia’s invasion of Ukraine is already affecting global markets and wiping out the two countries’ economies, but what’s to come could be far worse. Professors Mitu Gulati and Pierre-Hugues Verdier of the University of Virginia School of Law recently weighed in on the financial impact of the war and sanctions.

Is a Global Economic Crisis Looming?

Gulati, a leading expert on the law of sovereign debt restructuring and contracts, said events that have global economic impact happen about every 15 or 20 years. In the 1980s, it was a Latin American debt crisis; in the 1990s, there was a financial crisis in Asia; and in 2011, there was a European sovereign debt crisis on the heels of the 2008-09 global recession. In the past two years, the COVID-19 pandemic “sent up the warning flag for those of us who study financial markets,” he said.

During the pandemic, countries borrowed large amounts of money not only for health care and prevention efforts, but to counter the effects of their economies being dragged down by lockdowns.

“The hope was, once COVID is over, if nothing bad happens, then we can recover,” he said. “Potentially, Russia and Ukraine is the bad thing that is not going to allow the global economy to recover.”

Some countries will benefit from the crisis, he added, like those that produce commodities now in short supply, such as oil.

“But a lot of other countries that are weak and vulnerable and dependent on tourism, particularly Russian tourism, are going to do terribly.” He pointed to Sri Lanka, already on the brink of defaulting on its debts. Belarus, neighboring Russia, is also considered to be a high default risk. Countries that depend on Russia and Ukraine buying their products will also suffer.

“All of those countries are going to have a lot of hurt and a lot of hurt translates, in the main, to finding it more and more difficult to borrow on the international markets,” he said. “And on the flip side of that, the international markets — the institutions that are used to lend — are potentially also going to suffer, because if they held a lot of Russian debt, they’re going to take massive losses on that debt.”

Nations often raise money to finance debt by selling government bonds to investors, and about half of Russia’s debt bonds are held by foreign investors. Russia could default on its debt as early as Wednesday, when $117 million in interest payments are due.

“That would probably lead to the prices for Russian and Ukrainian bonds — and those of companies in those countries that were also borrowing on the international markets — crashing. And then, if investors get panicked about other countries, the implications are dire for a very fragile global economy,” he said. “These are a set of dominoes. Once there is panic, things can turn ugly very quickly.”

The Ukrainian sovereign debt is double that of the Russian debt, Gulati said, and Ukraine was on the brink of defaulting even before the invasion, so Ukraine will likely default soon as well, barring unforeseen circumstances. Under various scenarios Gulati and co-author Lee Buchheit outlined for the Financial Times, Russia is likely, under international law, to soon be obligated for the Ukrainian debt, making it potentially on par with some of the largest sovereign defaults in history — conservatively, upward of $150 billion.

The possible fate of Ukraine’s debt is important as a matter of international law, Gulati said.

“The relevant law on this is from the late 1800s and early to mid-1900s — maybe even early 1800s, because that’s when countries used to invade each other and take each other’s territory with impunity,” he said. “It’s an indication that the world has turned back to a period of history that was very, very ugly, and we’re having to ask those hard questions. It’s an indication that we are seeing something that we didn’t ever expect to see in our lifetimes. At least, I didn’t.”

In a normal sovereign default, the country might negotiate to alleviate its debt in order to repay some parts of it over time.

“This is going to be much more like when the czar was overthrown in the early 1900s and the new government just said ‘No, we’re a new country. We’re not paying anything,’” Gulati said. “We haven’t seen this kind of thing since the early 1990s. Most investors holding those Russian debt instruments still have not been paid.”

Unprecedented Sanctions Take a Toll

The worldwide sanctions on Russia clamped down quickly after the invasion of Ukraine.

“The sanctions are unprecedented, but launching a full-scale invasion of a country in Europe by one of the largest military powers in the world is also unprecedented in our lifetime,” said Verdier, an expert on global banking law and international financial litigation. “So everything about this is unprecedented. I wouldn’t say I’m surprised that the reaction is very strong given that the trigger for it is also a pretty shocking development.”

One example from the past that is useful to compare the situation to is sanctions on Iran, Verdier said. In that case, sanctions were phased in by the United States, the European Union and other countries over several years, “so there was a strategy to tighten the screws.”

“For Russia, we’ve cranked up the volume to a 10 or 11 in a very short span of time, so people are trying to figure out what exactly is going to be the impact of these sanctions and how to deal with them,” he said.

Verdier said the sanctions on the Central Bank of Russia and other major state-owned entities are unparalleled.

“And that has enormous repercussions. There are very few instances of central banks being sanctioned in foreign countries.”

That’s because central banks are essential to so many financial transactions. They manage foreign exchange reserves, which are used to stabilize currency by buying and selling the currency on the markets against other currencies, such as the U.S. dollar.

“If the Central Bank is unable to access its accounts in the United States, if it’s unable to enter into transactions that touch the United States, such as wire transfers or derivative transactions — all kinds of transactions that it enters into on a regular basis — then that’s going to handicap it considerably.”

Verdier said sanctions on the bank have been cited for crashing the Russian currency so rapidly. The ruble, now worth less than a cent to the dollar, has dropped nearly 40% in recent weeks.

There’s anticipation that the Central Bank “is not going to be able to play its normal role in stabilizing the currency, in addition to the impact of all of the other sanctions.”

Even companies not formally subject to these sanctions are halting business in Russia, as widely reported, he noted. Those that haven’t have faced blowback. Shell, Europe’s largest oil company, was criticized for buying a tanker of Russian crude at a significant discount. Shell apologized, noting that it had to make the purchase because it could not find alternative sources of oil for customers. Shell pledged to donate profits from the purchase to humanitarian causes. More recently the company said it was planning to withdraw entirely from involvement in Russia’s hydrocarbon market.

Though the level of sanctions “certainly is going to hurt Russia’s economy very substantially,” he said, there’s potential for the sanctions, as in the past, “to become leakier and leakier, in the sense that countries find a way around them.”

Iran tried to find ways around sanctions, but had several years to build workarounds.

“And so it was a process that continued, sort of whack-a-mole on the part of the sanctioning states and the Iranian government, trying to find new ways to do what they wanted to do.”

Verdier considered both the possible short-term and long-term impact of the sanctions on the global economy moving forward.

“In this short term, it’s going to continue taking an even bigger hit,” Verdier said. “And then over the long run, it’s hard to predict what will happen because it may be that the hit is so big that it’s going to throw the economy into a major depression.”

But it’s also possible that the collapse of Russia’s limited economy, which has never been that strong, may have less impact worldwide.

“Russia is not embedded in global supply chains in the way that, for example, China is, so how disruptive isolating Russia is really going to be for the rest of the world is a bit of an open question,” he said. “Certainly, there will be a substantial impact on world markets in oil, gas and other commodities, and also on food markets.”

There are also still many unknowns, he added.

“If Russia actually manages to take over the Ukraine military, and then the sanctions become permanent or semi-permanent, then what happens? What’s the next step? That’s going to be the big question.”

Related News

- 4.26.22 Food Markets Face Major Impact From Ukraine Conflict

- 4.8.22 Conflict in Ukraine Suggests Turning Point for International Cooperation, Professors Say

- 3.8.22 Ukraine and the Future of War Crimes

- 2.28.22 From Sanctions to Cyberattacks: What’s Next in the Ukraine Conflict?

- 2.21.22 Professor Says It’s Important To Understand Russia’s Goals in Conflict Over Ukraine

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.