Laws get broken on the hit HBO show “Succession,” but that’s not because lawyers aren’t there to lend a hand.

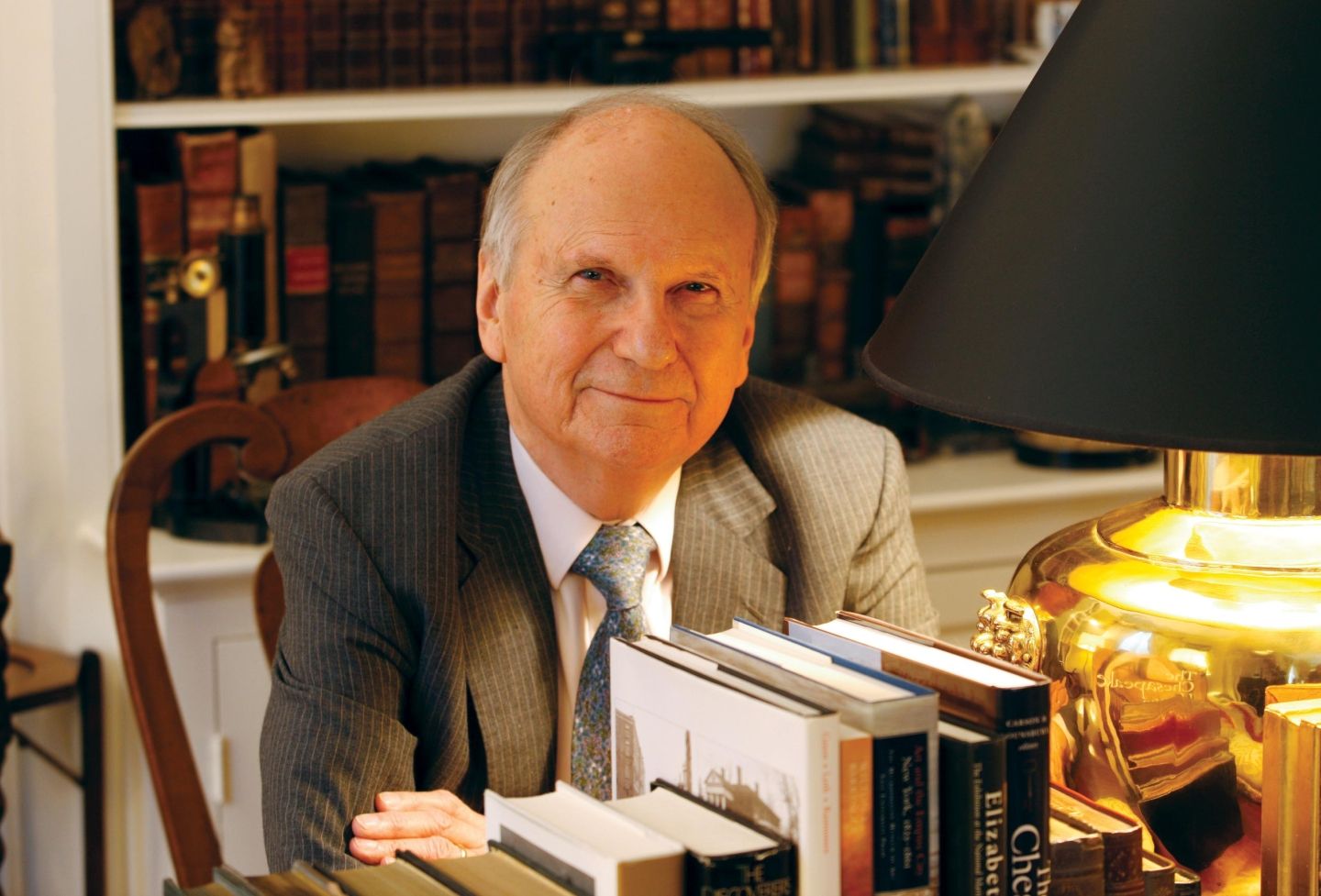

Peter Lyons, a University of Virginia graduate and UVA Law lecturer, is a legal consultant for the show, and offers the writers advice on how to keep the characters on the right side of legal plausibility. He’s teaming up with Professor Cathy Hwang to teach a Law School January term course starting Tuesday about the kinds of thorny legal questions that come up on the Emmy-winning series.

The show, which just wrapped its third season, began as the health of family patriarch Logan Roy, who runs the global media and entertainment conglomerate Waystar Royco, comes into question. The family members’ dysfunctional scheming quickly follows.

“It has been a lot of fun,” Lyons said. “The writers often try to push the conflicts among the characters, and I need to embrace the conflicts and try to be sure the situations giving rise to the conflicts could actually happen. It’s quite a change; clients ordinarily want us to help them minimize conflict.”

Lyons is a corporate lawyer who has specialized in mergers and acquisitions since 1986. He was the head of the M&A group at Shearman & Sterling and has been an M&A attorney at Freshfields Bruckhaus Deringer since 2014. He got involved in advising the show through a British work connection to the show’s principal business consultant, who needed advice about some of the U.S. corporate law issues that come up in the show.

From “poison pills” to the “bear hug,” there was a lot for the writers to learn.

Though he mostly consults via phone, Lyons visited the set for a week during the filming of the third season’s fifth episode, which centers on the proxy contest that comes to a head at the Waystar/Royco annual shareholders meeting.

“I was helping with the cadence of the meeting, as well as the look and feel of the meeting and the ‘war rooms’ where the different sides hunkered down during the negotiations,” Lyons said.

Despite the show’s high drama, Lyons said there’s some truth to the scenarios.

“I think that most of the corporate intrigue could happen,” Lyons said. “Not very often and not in quite this way, but something very close to these scenes does occur.”

Lyons said he helped the show figure out how to establish the corporate machinery underlying the confrontations between Logan (played by actor Brian Cox) and his children in the final scene of season 3. (Spoilers ahead.)

“The business consultant and I came up with the idea that the Roys would have a family holding company — similar to National Amusements, which holds the Redstone ownership interest in Viacom/CBS,” Lyons explained.

The bylaws of that holding company were amended as part of the revision of Logan’s divorce settlement that induced his wife, Caroline, to support Logan in the proxy contest.

“That amendment included a requirement that a supermajority of the holding company shareholders approve any change of control of Waystar Royco,” Lyons said, “thus allowing all the family shareholders acting together to fend off a takeover.”

If that sounds complicated, then you get the idea of why such a course would help educate future corporate lawyers, many of whom participate in the school’s John W. Glynn, Jr. Law & Business Program.

“The goal of the course is to dive into some of the corporate law questions and show students how these might shake out in their real-life practices,” Hwang said. “For example, we discuss whether Logan should have disclosed his illness as a matter of securities law. Students debate the issue and practice explaining their rationale to a board of directors.”

For that question, Hwang added, the course is having alumna Susan Muck ’86, a securities lawyer at the law firm WilmerHale who regularly deals with these kinds of disclosure issues, talk to the students about what she would advise the company to do.

Before she became a law professor, Hwang also worked on mergers and acquisitions at the law firm Skadden, Arps, Slate, Meagher & Flom, and M&A is one of the subjects she writes about in her scholarship today. Three of her articles have been voted by business law professors as among the top 10 corporate and securities law articles of the year.

Hwang and Lyons will engage their students in other exercises that focus on corporate law issues similar to those addressed on the show.

A bear hug, by the way, happens when one company publicly offers to acquire another company for a much higher price than the company’s shares are traded for in the market.

“Boards have to do what’s best for shareholders, so if the bear hug is a particularly high price, the board may have no choice but to seriously consider selling the company,” Hwang said. “It’s a very public way for an acquirer to say they want to buy the company, sometimes after unsuccessful private negotiations beforehand.”

Poison pills allow a company’s shareholders the right to buy additional shares at a steep discount, which can dilute the ownership interest of a new, hostile party. The defense tactic can be used to discourage, or at least delay, a hostile takeover.

January term courses, typically offered over four or five days as one-credit classes before the spring semester starts, allow students to take a quick, but deep, dive into a specific topic. Other courses offered next week include Cryptocurrency Law and Policy, and Title IX: The Law and Policy of Sex Discrimination in Education, to name a couple.

“Succession” has been renewed for a fourth season, so students may have even more to learn next January.

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.