At times dismissed by members of the older generation, millennials and their social views are earning new respect from one of the traditional quarters of the old guard — the corporate boardroom. That’s the finding of a pair of professors at the University of Virginia School of Law and their co-author in a new paper.

On Aug. 19, the Business Roundtable, a consortium of CEOs for the nation’s largest firms, announced in a public statement that corporations have an obligation to serve the interests of not just shareholders, but also employees, customers and society at large.

Professors Michal Barzuza and Quinn Curtis of UVA Law, and Professor David Webber of the Boston University School of Law, say they see a straight line between the announcement and the research in their recently co-authored paper, “Shareholder Value(s): Index Fund Activism and the New Millennial Corporate Governance.”

The paper argues that, as millennials advance social goals, they are also helping to shape corporate governance and that new ways of thinking about social goals in conventional corporations are now required.

The younger generation, to put it bluntly, is coming into money.

“Millennials are just starting to enter the phase of their lives where they will accrue a lot of wealth,” Curtis said. “The competition to manage that wealth is underway and a key dimension of that competition is going to be funds demonstrating that they share millennial values.”

The professors say index funds, which consist of a portfolio of companies meant to track with a market index, such as Standard & Poor’s 500 Index, are the fulcrum for corporate change because they are most susceptible to social pressure.

“Millennials place a premium on social values in their investments,” they write. “With prices for index funds already cut to the bone, and investment performance an irrelevant consideration for index investors, index funds must seek out differentiation in the market where they can find it. Using their voting power to promote their investors’ social values, and doing so publicly and loudly, is a way for these funds, which otherwise risk becoming commodities, to give investors a reason to choose them.”

They note that index funds are now the largest shareholders in many large companies, and that social activism exerted via index funds has led to greater gender diversity on corporate boards and new sustainability practices, among other changes.

Barzuza researches and teaches corporate law, corporate governance, corporate finance, regulatory competition, and law and economics. Her co-authored paper on long-term bias inspired an analysis in The Wall Street Journal.

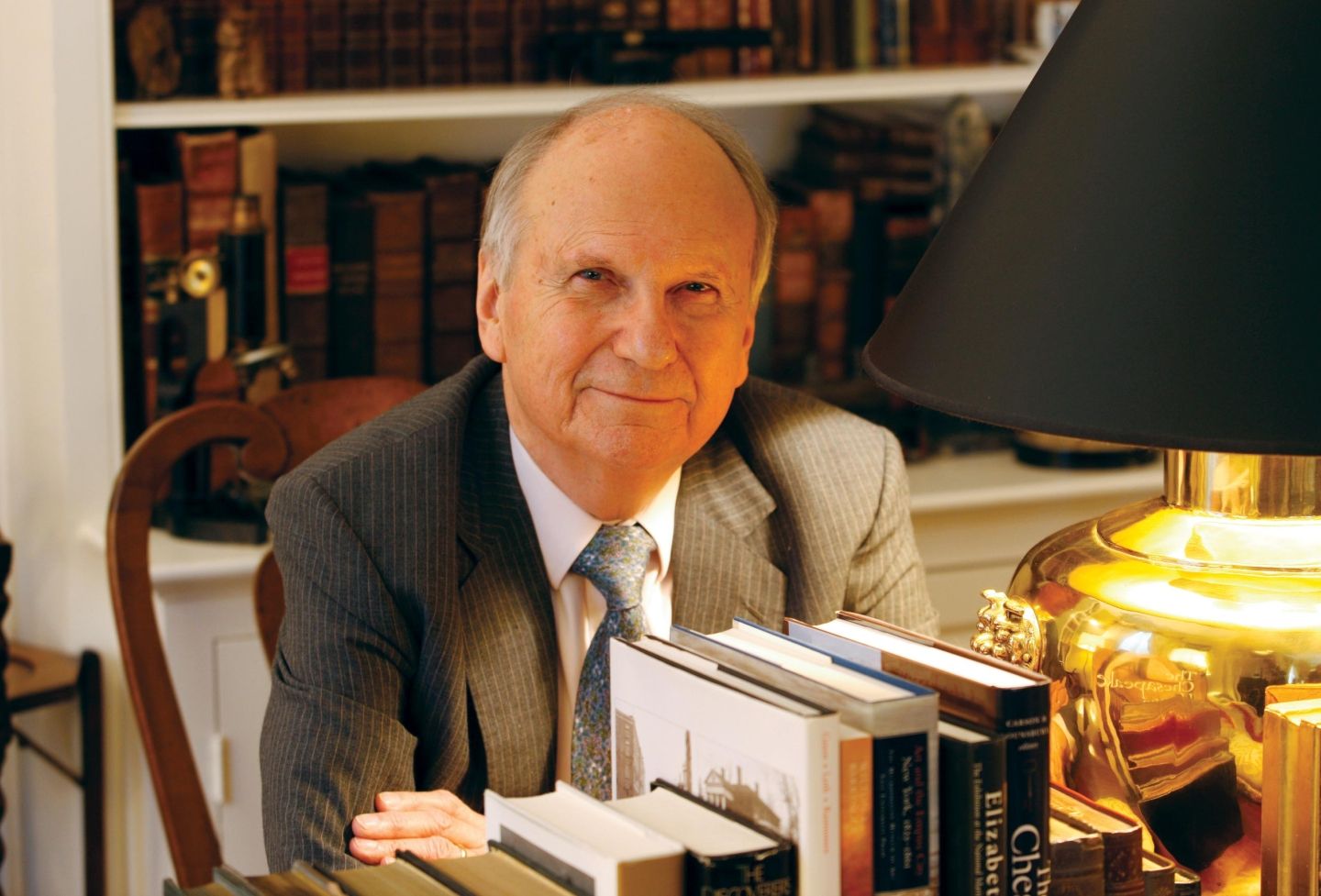

Curtis teaches courses on corporate law, securities and venture capital. His research focuses on empirical law and finance. He published an editorial in The Washington Post in May based on his paper about the hidden costs of 529 plans.

Webber is the author of “The Rise of the Working-Class Shareholder: Labor's Last Best Weapon,” published by Harvard University Press in April 2018.

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.