In a tradition going back 32 years, some of the nation’s leading experts in tax law will convene at the University of Virginia School of Law on Friday to discuss emerging issues in the field.

The Virginia Tax Study Group includes scholars, practicing attorneys and government officials who work in tax policy. This year’s meeting, sponsored by the Virginia Center for Tax Law, includes panel presentations and a keynote address by Will Morris LL.M. ’89, global tax policy leader at PwC US.

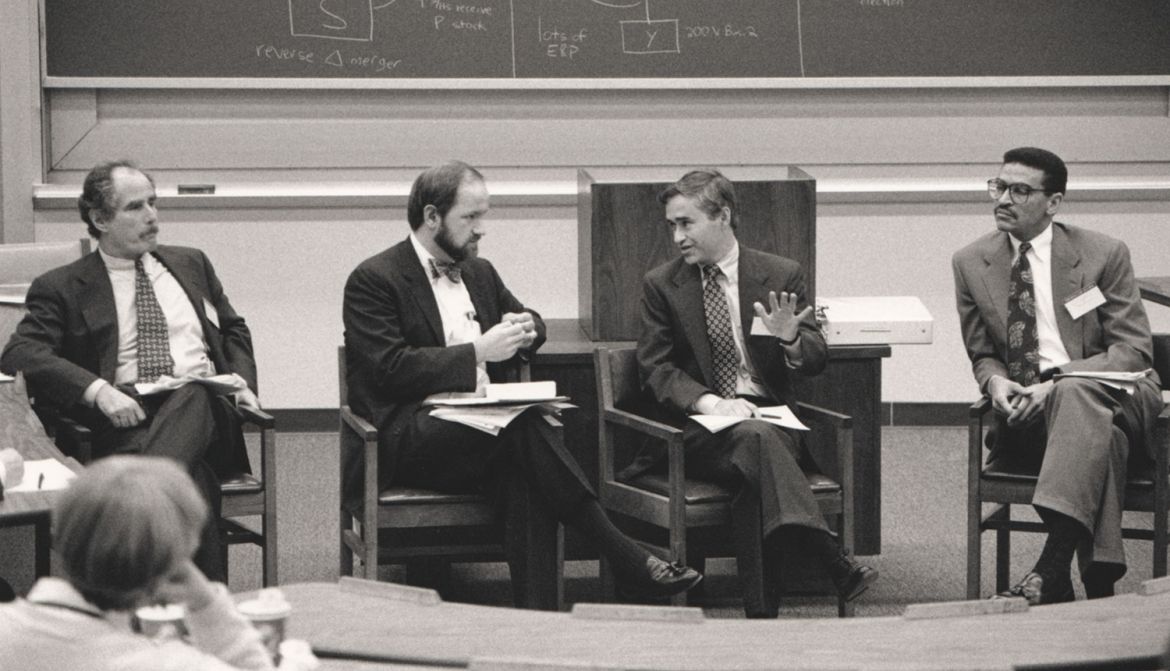

“The event’s style is what makes it stand out,” said Professor Ruth Mason, who directs the center and serves as the Edwin C. Cohen Distinguished Professor of Law and Taxation and Class of 1941 Research Professor of Law. “It’s a lively audience, with lots of input from the participants in addition to the panelists. Many of the people who attend have known each other for a very long time.”

Mason explained that major topics of discussion at the meeting will include the global minimum tax proposal — 144 countries’ agreement for multinational corporations’ income to be taxed at a minimum of 15%.

“To accomplish that would have required an unprecedented amount of coordination among countries in the tax area,” she said. “There are a lot of questions about it, so we’ve brought together experts to try to answer those questions.”

The other area of interest is Moore v. United States, a Supreme Court case exploring the question of whether income can be taxed before realization.

“That’s kind of a subsidiary question in the case, but it’s the outcome that everyone is interested in,” Mason said.

The case’s ruling, expected this spring or summer, could upend the tax code as we know it, she said. A decision in favor of the taxpayer could limit the government’s ability to tax various types of income, potentially forcing a major rewrite of tax laws.

“The point of this event is to bring people together,” Mason said. “Each session is determined by what’s happening in the tax world at the time, but they all share the common feature that it’s a warm and welcoming environment — one that is for open and friendly disagreement.”

In addition to keynote speaker Will Morris LL.M. ’89, alumni attending this year include Cecily Rock ’79, senior legislation counsel for the U.S. Congress Joint Committee on Taxation; Harry Franks ’88, a UVA Law lecturer and former leader of the tax planning group at Baker Hughes; Eric Solomon ’78, a partner with Ivins, Phillips & Barker and former assistant secretary for tax policy at the U.S. Treasury Department; Isaac Wood ’14, attorney-adviser for the Treasury Department’s Office of Tax Policy; and David Maranjian ’17, an associate with Cleary Gottlieb.

32 Years and Counting

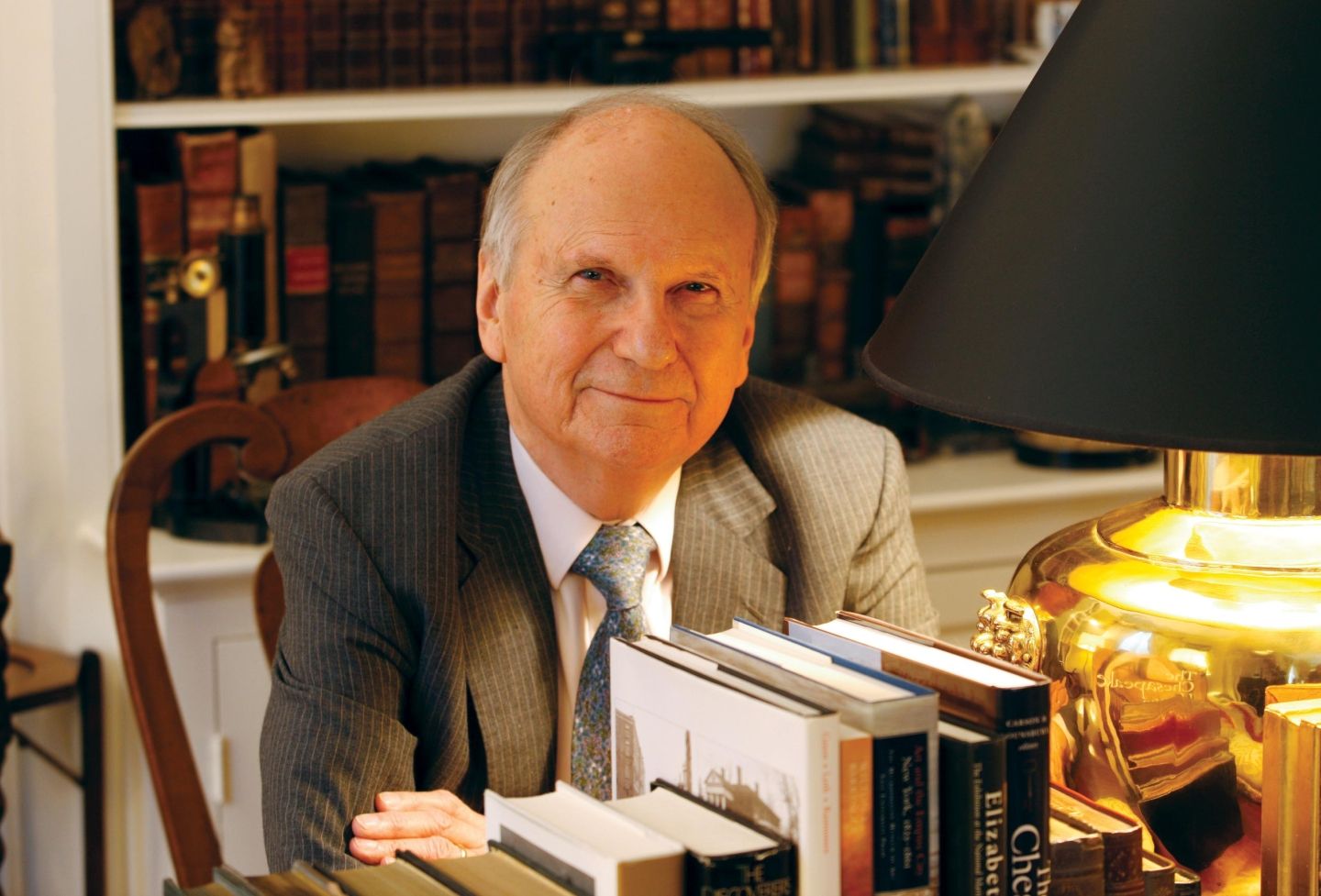

The Virginia Tax Study Group was organized in 1992 by Professor Emeritus Edwin S. Cohen ’36 as a way of bringing together his former students for an open discussion of current tax issues. Initially, twice-yearly meetings took place at the Law School and were followed by a catered dinner at Cohen’s home. The professor shouldered most of the related costs, according to Professor Emeritus Thomas White, who led the group for several years before retiring.

In time, many of Cohen’s former students continued to attend beyond graduation, amid illustrious legal careers. The meetings had to be scheduled for when Congress was not in session, so that alumni working on congressional staffs could participate.

Cohen died in early 2006 at the age of 91. By that time, the study group had built a reputation for the cutting-edge content of the meetings, which are now held once a year and funded by the Law School Foundation.

“The success of these meetings, at least in the early history, is derived in part from the prominence of Edwin Cohen in the tax field and the association of the Law School with Mortimer Caplin, who supported these meetings,” White said.

Caplin, a 1940 Law School graduate whose name graces the school’s Caplin Pavilion, Caplin Auditorium and the Mortimer Caplin Public Service Center, served as IRS commissioner under President John F. Kennedy.

While other law schools organize seminars and presentations of tax topics, White said the study group is unique because of its success as an alumni function and in attracting the participation of prominent tax alumni and other tax professionals.

“Their success redounds to the success and reputation of the Law School’s tax department,” White said.

Founded in 1819, the University of Virginia School of Law is the second-oldest continuously operating law school in the nation. Consistently ranked among the top law schools, Virginia is a world-renowned training ground for distinguished lawyers and public servants, instilling in them a commitment to leadership, integrity and community service.